ad valorem tax florida real estate

The gross amount is. The homestead exemption and Save Our Homes assessment.

Property Tax Information Palm Beach Fl Official Website

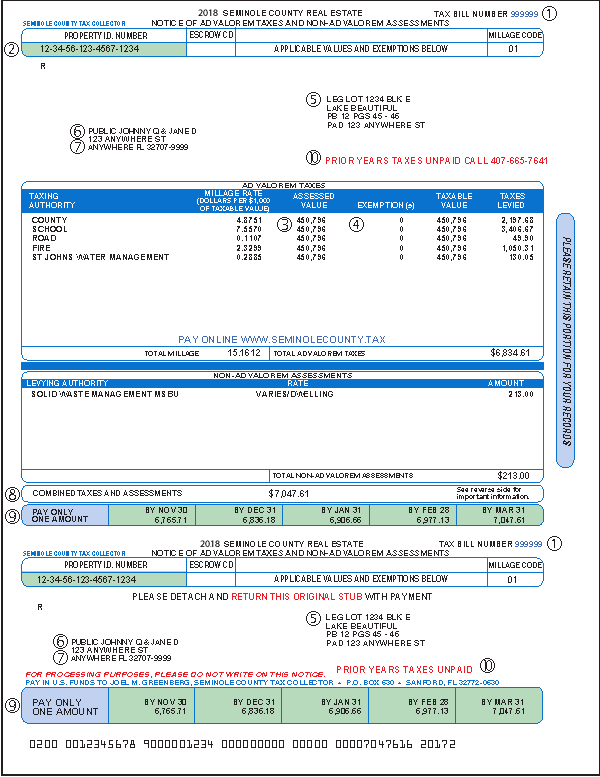

194 a petitioner who challenges the assessed value of real property with the Value Adjustment Board must pay all the Non-Ad Valorem Assessments and pay at.

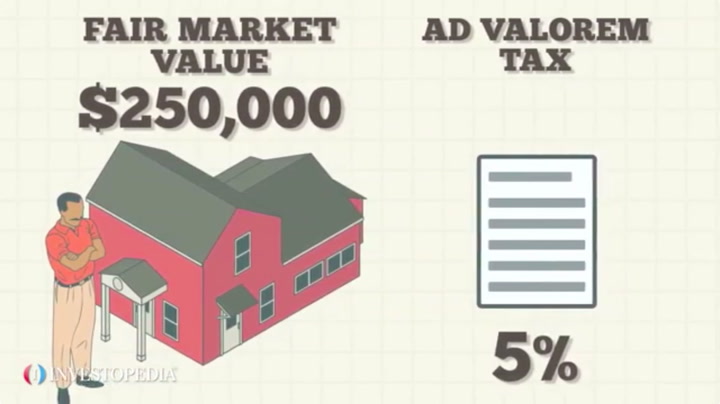

. The most common ad valorem tax examples include property taxes on real. An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad valorem taxes are property taxes levied on real.

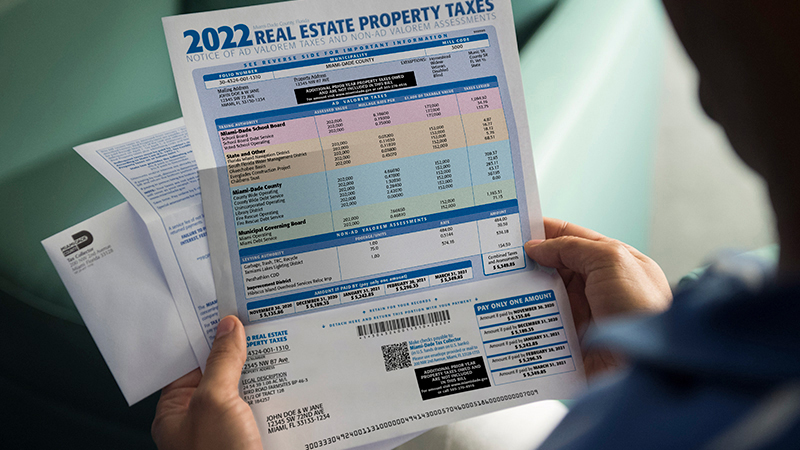

Property Taxes are payable in November with a 4 discount. IF PAID IN TOTAL DUE. These are levied by the county municipalities.

January a 2 discount. Florida Ad Valorem Valuation and Tax Data Book. Pursuant to State Law FS.

There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. The most common ad valorem tax examples include property taxes on real estate. A tax on land building and land improvements.

Taxable Property Value of 75000 1000 75. Property Tax bills are mailed to property owners by November 1 of each year. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal.

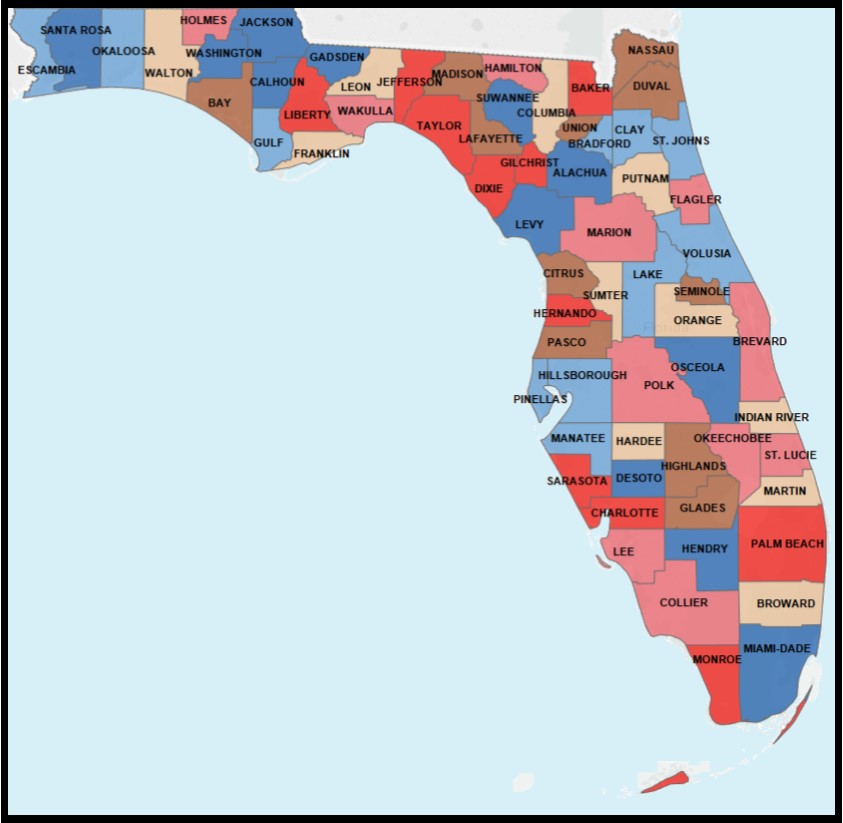

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other levying bodies set the millage. Real estate property taxes. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem taxes.

Notice Of AD Valorem Taxes Non-AD Valorem Assessments. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad valorem taxes are based on the value of.

Real estate taxes comprise ad valorem taxes and non-ad valorem assessments while personal property taxes are solely ad valorem. Ad valorem means based on value. Tax bills are mailed on or around November 1 each year.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. Considered ad-valorem meaning according to worth. The Tax Collector also collects.

The collection of taxes as well as the assessment is in accordance. Pay Taxes Property Taxes. Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability.

An ad valorem tax is a tax that is based on the assessed value of a property product or service. The Property Appraiser establishes the taxable value of real. 75 x 72 mills 540 in City Taxes Due.

The Tax Collector collects all ad valorem taxes levied in Polk County. Based on the value of the property as determined by. Non-Ad Valorem assessments are primarily assessments for fire services and solid waste collection and disposal.

These tax statements are mailed out on or before. There are three ways to pay your property taxes online with Paperless in person or by mail. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector.

The tax year runs from January 1 to December 31. Valorem taxes or real property taxes. Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments.

The greater the value the higher the assessment. Are based on the value of such property and are paid in arrears the end of the tax year. R 00-00-075-000-10238-006 REAL ESTATE TAXNOTICE RECEIPT FOR WAKULLA COUNTY.

February a 1 discount.

Property Taxes By State 2016 Eye On Housing

Florida Dept Of Revenue Property Tax Data Portal County Profiles

Orange County Property Appraiser Home Page

Understanding Your Tax Bill Seminole County Tax Collector

Florida Property Taxes Explained

Florida Dept Of Revenue Property Tax Data Portal

Pay Your County Tax Bill By Nov 30 And You Get A 4 Percent Discount Palm Beach Florida Weekly

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Charlotte County Tax Collector Property Tax

Sales And Use Tax On Commercial Property Rental Florida Sales

Ad Valorem Tax Definition And How It S Determined

Homestead Exemption An Awesome Property Tax Break For Florida Homeowners Verobeach Com

Property Taxes Monroe County Tax Collector

Florida Voters To Decide Property Tax Breaks

Florida Property Tax Consulting Firm Property Tax Consulant

Save On Your Property Tax Bill

Martin County Property Appraiser Property Tax Estimator

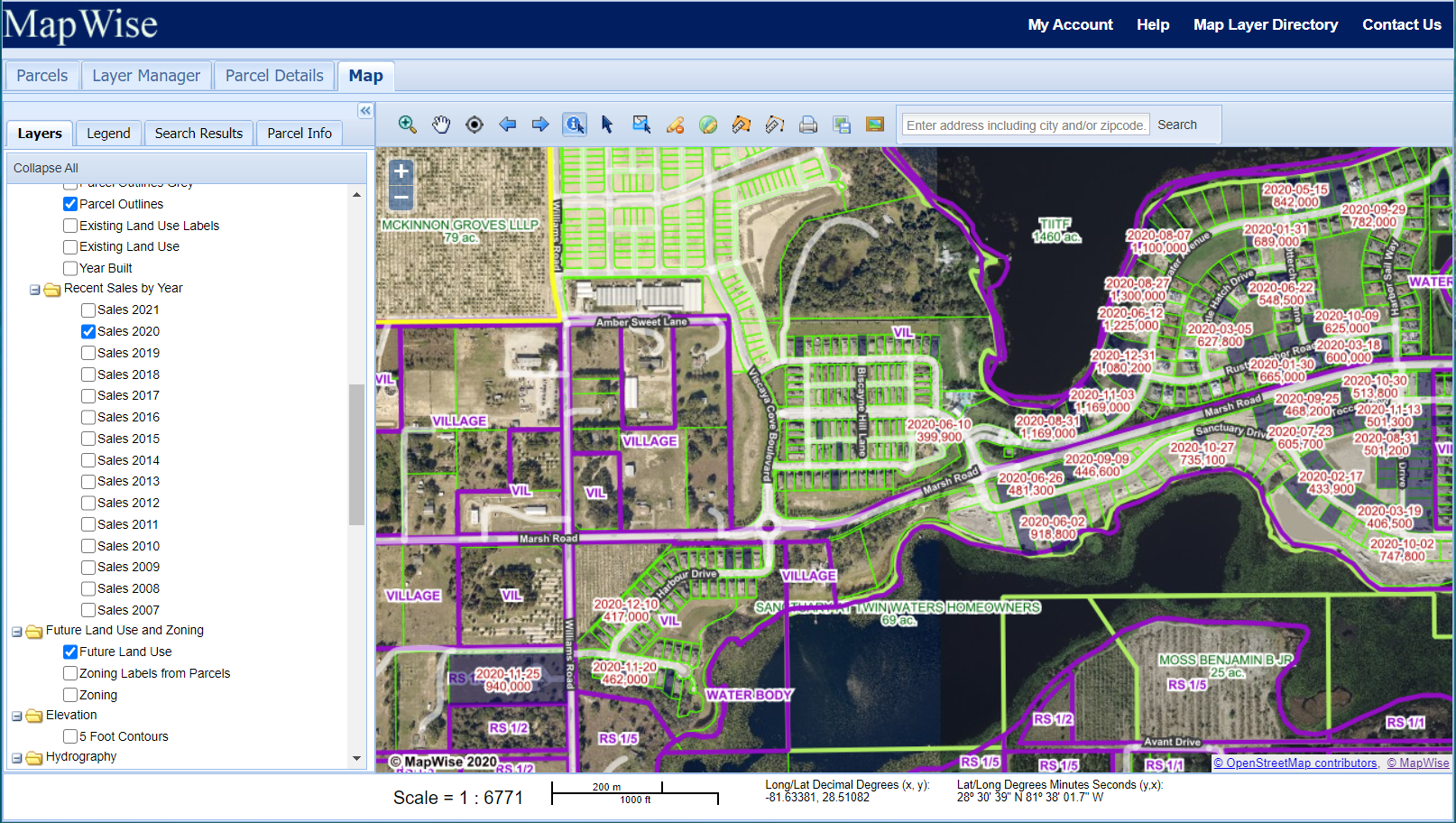

Florida County Property Appraiser Search Parcel Maps And Data

Are There Any States With No Property Tax In 2022 Free Investor Guide